Giving is great!

Read the Article at HuffingtonPost

Monday, March 14, 2011

Biz Stone and the Power of Giving Back

Giving is a great idea. Check out my blog on Giving at

http://sur

and

http://kau

Giving can help us cope with deficits and relieve us of tax burdens.

Read the Article at HuffingtonPost

http://sur

and

http://kau

Giving can help us cope with deficits and relieve us of tax burdens.

Read the Article at HuffingtonPost

Tuesday, March 8, 2011

Women’s Empowerment in India’s Parliament and Government in March 2011

Parliamentary democracies like India that practice one person one vote should ideally have people’s representatives in elected bodies such that the Parliament and the government reflect the gender composition of the population which is roughly 50-50. The International Women’s Day being celebrated on March 8 each year has prompted me to look into the facts which reveal that India has a big gap between the ideal and the reality on March 8, 2011. India’s Parliament has two houses: the Lower House (Lok Sabha) and the Upper House (Rajya Sabha).

Lok Sabha consists of 552 members of which 60 (almost 11 percent) are women; 59 represent 16 of the 28 states and 1 represents 1 of the 7 Union territories.

The state-wise distribution of the 60 seats is as follows:

State/Territory Seats Percentage

Uttar Pradesh 12 (20 percent)

West Bengal 7 (12 percent)

Madhya Pradesh 6 (10 percent)

Andhra 5 (8 percent)

Bihar 5 (8 percent)

Gujarat 4 (7 percent)

Punjab 4 (7 percent)

Chhattisgarh 3 (5 percent)

Maharashtra 3 (5 percent)

Rajasthan 3 (5 percent)

Assam 2 (3 percent)

Haryana 2 (3 percent)

Delhi 1 (2 percent)

Karnataka 1 (2 percent))

Meghalaya 1 (2 percent)

Tamil Nadu 1 (2 percent)

Total 60 (100 percent)

Political party affiliation of the 60 women parliamentarians in Lok Sabha is as follows:

Political Party Seats Percentage

Indian National Congress 24 (40 percent)

Bharatiya Janata Party 13 (22 percent)

All IndiaTrinamool Congress 4 (7 percent)

Bahujan Samaj Party 4 (7 percent)

Samajwadi Party 3 (5 percent)

Janata Dal (United) 2 (3 percent)

Nationalist Congress Party 2 (3 percent)

Shiromani Akali Dal 2 (3 percent)

Communist Party of India (Marxist) 1 (2 percent)

Dravida Munnetra Kazhagam 1 (2 percent)

Independent 1 (2 percent)

Rastriya Lok Dal 1 (2 percent)

Shiv Sena 1 (2 percent)

Telangana Rashtra Samithi 1 (2 percent)

Total 60 (100percent)

The state-wise representation by a total of 26 women from 15 of the 35 states and union territories in the Rajya Sabha is as follows:

State/Territory Seats Percentage

Madhya Pradesh 3 (12 percent)

Tamil Nadu 3 (12 percent)

Andhra Pradesh 2 (8 percent)

Himachal Pradesh 2 (8 percent)

Orissa 2 (8 percent)

Assam 1 (4 percent)

Chhattisgarh 1 (4 percent)

Gujarat 1 (4 percent)

Jharkhand 1 (4 percent)

Kerala 1 (4 percent)

Punjab 1 (4 percent)

Rajasthan 1 (4 percent)

Tripura 1 (4 percent)

Uttar Pradesh 1 (4 percent)

West Bengal 1 (4 percent)

Nominated 4 (15 percent)

Total 26 (100)

Political party affiliation of 26 women members of Rajya Sabha is as follows:

Political Party Seats Percentage

Indian National Congress 11 (42 percent)

Bharatiya Janata Party 5 (19 percent)

Communist Party of India (Marxist) 3 (12 percent)

Dravida Munnetra Kazhagam 2 (8 percent)

Biju Janata Dal 1 (4 percent)

Telugu Desam Party 1 (4 percent)

Nominated by the President of India 3 (12 percent)

Total 26 (100 percent)

States and territories of (1) Andaman and Nicobar Islands, (2) Arunachal Pradesh, (3) Chandigarh, (4) Dadra and Nagar Haveli, (5) Daman and Diu, (6) Goa, (7) Jammu and Kashmir, (8) Lakshadweep, (9) Manipur, (10) Mizoram, (11) Nagaland, (12) Puducherry, (13) Sikkim, (14) Uttarakhand do not have any women member in India’ Parliament.

It is estimated that some 11 percent of all corporate chiefs India are women.

Clearly women’s representation at the top of the governing structures is low with 10 percent of seats compared with 90 percent representation made by men. Indian National Congress and Bharatiya Janata Party dominate women parliamentarians compared with other parties. The states of Madhya Pradesh, Uttar Pradesh and West Bengal stand out among the states with more women members of Parliament.

Many questions come to mind foremost among them being why there is such a low percentage of seats held by women, how it can be improved and comparison of India with other countries in terms of percentage of women in top authority and decision making positions in society. These questions will be addressed in future blogs.

It is noteworthy that India’s President, Speaker of Lok Sabha, Leader of Opposition in Lok Sabha and president of the Indian National Congress party are all women. There are 3 women in a Union Cabinet of 35 Ministers, 1 of 6 Ministers with Independent Charge, 3 of 37 Ministers of State in Prime Minister Dr. Manmohan Singh’s government. There are no Supreme Court judges. There are 3 Governors/Lt. Governors/Administrators of 35 states and territories, and 2 Chief Ministers of 29 states and territories. Overall women occupy about 10 percent of all top political positions in India. It is a long march towards 50 percent.

The entire process has to be streamlined and strengthened with financial support and training to develop leaders. The present quota system at the local level based on gender, caste, etc. is largely abused by men.

School curriculum, colleges, and MLAs, MPs not connected to men leaders have to be developed through genuine education and skills with scholarships, training programs and centers of study, research, degrees like Bachelor and Master of Public Admin, Leadership, etc.

Institutions and programs are needed but men leaders like the PM also have to give a chance to women and put them on top! 10 percent is too low. It will take much longer to have up stream flow of women leaders from grassroots to the top. Even many of the present district level women leaders, MLAs and MPs are relatives of men leaders. It is much easier and faster to put shining examples in the cabinet, ministers, commission members, Vice Chancellors, some professors, civil leaders at district levels, etc.

There are only about 10 most popular women leaders today as examples to 600 million women in India- Pratibha Patil, Sonia Gandhi, Mamata Banerjee, Girija Vyas, Jayalalithaa, Mayawati, Sushma Swaraj, Meira Kumar, Najma Heptulla, Kiran Bedi, Shabna Azmi, Hema Malini, and Brinda Karat, along with a handful of another 50 or so at the national level. Majority of these are there because of their father, husband or another relative.

It is a waste of potential national resource not to have more women leaders and a pipeline of future leaders in business, government, politics, and science. On this International Women’s Day, best wishes to women in the next year and all the years to follow.

Parliamentary democracies like India that practice one person one vote should ideally have people’s representatives in elected bodies such that the Parliament and the government reflect the gender composition of the population which is roughly 50-50. The International Women’s Day being celebrated on March 8 each year has prompted me to look into the facts which reveal that India has a big gap between the ideal and the reality on March 8, 2011. India’s Parliament has two houses: the Lower House (Lok Sabha) and the Upper House (Rajya Sabha).

Lok Sabha consists of 552 members of which 60 (almost 11 percent) are women; 59 represent 16 of the 28 states and 1 represents 1 of the 7 Union territories.

The state-wise distribution of the 60 seats is as follows:

State/Territory Seats Percentage

Uttar Pradesh 12 (20 percent)

West Bengal 7 (12 percent)

Madhya Pradesh 6 (10 percent)

Andhra 5 (8 percent)

Bihar 5 (8 percent)

Gujarat 4 (7 percent)

Punjab 4 (7 percent)

Chhattisgarh 3 (5 percent)

Maharashtra 3 (5 percent)

Rajasthan 3 (5 percent)

Assam 2 (3 percent)

Haryana 2 (3 percent)

Delhi 1 (2 percent)

Karnataka 1 (2 percent))

Meghalaya 1 (2 percent)

Tamil Nadu 1 (2 percent)

Total 60 (100 percent)

Political party affiliation of the 60 women parliamentarians in Lok Sabha is as follows:

Political Party Seats Percentage

Indian National Congress 24 (40 percent)

Bharatiya Janata Party 13 (22 percent)

All IndiaTrinamool Congress 4 (7 percent)

Bahujan Samaj Party 4 (7 percent)

Samajwadi Party 3 (5 percent)

Janata Dal (United) 2 (3 percent)

Nationalist Congress Party 2 (3 percent)

Shiromani Akali Dal 2 (3 percent)

Communist Party of India (Marxist) 1 (2 percent)

Dravida Munnetra Kazhagam 1 (2 percent)

Independent 1 (2 percent)

Rastriya Lok Dal 1 (2 percent)

Shiv Sena 1 (2 percent)

Telangana Rashtra Samithi 1 (2 percent)

Total 60 (100percent)

The state-wise representation by a total of 26 women from 15 of the 35 states and union territories in the Rajya Sabha is as follows:

State/Territory Seats Percentage

Madhya Pradesh 3 (12 percent)

Tamil Nadu 3 (12 percent)

Andhra Pradesh 2 (8 percent)

Himachal Pradesh 2 (8 percent)

Orissa 2 (8 percent)

Assam 1 (4 percent)

Chhattisgarh 1 (4 percent)

Gujarat 1 (4 percent)

Jharkhand 1 (4 percent)

Kerala 1 (4 percent)

Punjab 1 (4 percent)

Rajasthan 1 (4 percent)

Tripura 1 (4 percent)

Uttar Pradesh 1 (4 percent)

West Bengal 1 (4 percent)

Nominated 4 (15 percent)

Total 26 (100)

Political party affiliation of 26 women members of Rajya Sabha is as follows:

Political Party Seats Percentage

Indian National Congress 11 (42 percent)

Bharatiya Janata Party 5 (19 percent)

Communist Party of India (Marxist) 3 (12 percent)

Dravida Munnetra Kazhagam 2 (8 percent)

Biju Janata Dal 1 (4 percent)

Telugu Desam Party 1 (4 percent)

Nominated by the President of India 3 (12 percent)

Total 26 (100 percent)

States and territories of (1) Andaman and Nicobar Islands, (2) Arunachal Pradesh, (3) Chandigarh, (4) Dadra and Nagar Haveli, (5) Daman and Diu, (6) Goa, (7) Jammu and Kashmir, (8) Lakshadweep, (9) Manipur, (10) Mizoram, (11) Nagaland, (12) Puducherry, (13) Sikkim, (14) Uttarakhand do not have any women member in India’ Parliament.

It is estimated that some 11 percent of all corporate chiefs India are women.

Clearly women’s representation at the top of the governing structures is low with 10 percent of seats compared with 90 percent representation made by men. Indian National Congress and Bharatiya Janata Party dominate women parliamentarians compared with other parties. The states of Madhya Pradesh, Uttar Pradesh and West Bengal stand out among the states with more women members of Parliament.

Many questions come to mind foremost among them being why there is such a low percentage of seats held by women, how it can be improved and comparison of India with other countries in terms of percentage of women in top authority and decision making positions in society. These questions will be addressed in future blogs.

It is noteworthy that India’s President, Speaker of Lok Sabha, Leader of Opposition in Lok Sabha and president of the Indian National Congress party are all women. There are 3 women in a Union Cabinet of 35 Ministers, 1 of 6 Ministers with Independent Charge, 3 of 37 Ministers of State in Prime Minister Dr. Manmohan Singh’s government. There are no Supreme Court judges. There are 3 Governors/Lt. Governors/Administrators of 35 states and territories, and 2 Chief Ministers of 29 states and territories. Overall women occupy about 10 percent of all top political positions in India. It is a long march towards 50 percent.

The entire process has to be streamlined and strengthened with financial support and training to develop leaders. The present quota system at the local level based on gender, caste, etc. is largely abused by men.

School curriculum, colleges, and MLAs, MPs not connected to men leaders have to be developed through genuine education and skills with scholarships, training programs and centers of study, research, degrees like Bachelor and Master of Public Admin, Leadership, etc.

Institutions and programs are needed but men leaders like the PM also have to give a chance to women and put them on top! 10 percent is too low. It will take much longer to have up stream flow of women leaders from grassroots to the top. Even many of the present district level women leaders, MLAs and MPs are relatives of men leaders. It is much easier and faster to put shining examples in the cabinet, ministers, commission members, Vice Chancellors, some professors, civil leaders at district levels, etc.

There are only about 10 most popular women leaders today as examples to 600 million women in India- Pratibha Patil, Sonia Gandhi, Mamata Banerjee, Girija Vyas, Jayalalithaa, Mayawati, Sushma Swaraj, Meira Kumar, Najma Heptulla, Kiran Bedi, Shabna Azmi, Hema Malini, and Brinda Karat, along with a handful of another 50 or so at the national level. Majority of these are there because of their father, husband or another relative.

It is a waste of potential national resource not to have more women leaders and a pipeline of future leaders in business, government, politics, and science. On this International Women’s Day, best wishes to women in the next year and all the years to follow.

Sunday, March 6, 2011

Interactive Discussion of India's Budget for 2011-2012

Interactive Discussion on Union Budget 2011-12

Interactive Discussion on Union Budget 2011-12

The Consulate General of India, New York organised an interactive panel discussion on the Indian Union Budget on 28th February 2011, at the Consulate Ballroom. Representatives of financial institutions, academicians from various universities, company executives, media persons, and community members attended the lively interactive discussion.

Dr. A.M. Gondane, Deputy Consul General, welcoming the guests introduced broad outlines of the Budget and the Economic Survey. He stated that the Indian economy had come out of the sluggishness consequent to the global financial crisis in 2007 and was on the path of recovery with achievement of 8.6% growth during the current financial year and is projected to grow at slightly over 9% in the year 2011-12. He said that India’s GDP during the current year is estimated to be Rs.7877947 crore (US$ 1.75 trillion) at current market price. He stated that the Budget aimed at consolidation of the fiscal position of the Government bringing the deficit to 4.6% in 2011-12 and 3.5% in year 2013-14, encompassed inclusiveness with increased social spending on education, health and rural development, and would impart developmental orientation by way of increased spending on infrastructure, Bharat Nirman and the other vital sector of the economy.

Dr. Rajiv Sobti, MD, Chief Investment Officer, Nomura office at the World Trade Center, New York stated that the Budget was balanced with several vital sectors focused for growth. He stated that some explicit measures for developing the secondary market in derivatives would give a fillip to investments by financial institutions and funds from abroad. He appreciated the opening of investments in mutual fund by foreigners. He stated that bond and debt market opening was imperative for increased flow of funds from abroad to meet the gap between investments desired and domestic resources. He emphasized that real interest rates in India were low hence long term capital was not coming into India.

Prof. Surendra K. Kaushik, Professor of Finance, Lubin School of Business, Pace University stated that though the outlays on social sectors – health and education had been increased substantially, yet, the expenditure was not enough to meet the growing needs of the young demographics in India. Increased allocation amounting to 48.5% of total plan allocation for infrastructure was indicative of the focus of Government on development of infrastructure. He said that the taxation rate in India was rather low as compared to the United States and Indian tax collection was less than 10% of the GDP. He appreciated the exemption given to senior citizens over 60 years and another category of senior citizens over 80 years which was anticipating the future reality. Prof. Kaushik appreciated tax reforms underway including Goods and Services Tax (GST) and the Direct Tax Code (DTC) which were under discussion with several stakeholders including the State Governments and the intention of the Finance Minister to bring a Constitutional Amendment Bill to facilitate this was a very welcome step.

Mr. Sarav Periasami, President and CEO of PERI Software Solutions Inc. emphasized the importance of education and the necessity to bring about clarity for inviting foreign investment in education sector in India. He appreciated the increased allocation of funds by 24% over last year. He said that financial resources were not the only constraints but clarity in regulation would create a favorable climate for developing this very vital sector. He said that increase in Minimum Alternate Tax (MAT) by 0.5% will affect business sentiment. He also said that levying service tax on other services or bringing in more items under the excise would also be a dampener for business sentiments.

All panelists felt that though growth was an imperative for raising the level of living standards, control of inflation was also very important. Inflation was detrimental to fixed income and lower income groups and supply constraints should be progressively removed.

In the lively question-answer session, comments about current account deficit, declining FDI, comparison of growth in China and India, encouragement to innovation, contribution of non-resident or persons of Indian origin abroad, etc. were responded to by the panelists.

The lively interactive discussion was followed by dinner.

Event From Date : Feb-28,2011 Event To Date : Feb-28,2011

Interactive Discussion on Union Budget 2011-12

The Consulate General of India, New York organised an interactive panel discussion on the Indian Union Budget on 28th February 2011, at the Consulate Ballroom. Representatives of financial institutions, academicians from various universities, company executives, media persons, and community members attended the lively interactive discussion.

Dr. A.M. Gondane, Deputy Consul General, welcoming the guests introduced broad outlines of the Budget and the Economic Survey. He stated that the Indian economy had come out of the sluggishness consequent to the global financial crisis in 2007 and was on the path of recovery with achievement of 8.6% growth during the current financial year and is projected to grow at slightly over 9% in the year 2011-12. He said that India’s GDP during the current year is estimated to be Rs.7877947 crore (US$ 1.75 trillion) at current market price. He stated that the Budget aimed at consolidation of the fiscal position of the Government bringing the deficit to 4.6% in 2011-12 and 3.5% in year 2013-14, encompassed inclusiveness with increased social spending on education, health and rural development, and would impart developmental orientation by way of increased spending on infrastructure, Bharat Nirman and the other vital sector of the economy.

Dr. Rajiv Sobti, MD, Chief Investment Officer, Nomura office at the World Trade Center, New York stated that the Budget was balanced with several vital sectors focused for growth. He stated that some explicit measures for developing the secondary market in derivatives would give a fillip to investments by financial institutions and funds from abroad. He appreciated the opening of investments in mutual fund by foreigners. He stated that bond and debt market opening was imperative for increased flow of funds from abroad to meet the gap between investments desired and domestic resources. He emphasized that real interest rates in India were low hence long term capital was not coming into India.

Prof. Surendra K. Kaushik, Professor of Finance, Lubin School of Business, Pace University stated that though the outlays on social sectors – health and education had been increased substantially, yet, the expenditure was not enough to meet the growing needs of the young demographics in India. Increased allocation amounting to 48.5% of total plan allocation for infrastructure was indicative of the focus of Government on development of infrastructure. He said that the taxation rate in India was rather low as compared to the United States and Indian tax collection was less than 10% of the GDP. He appreciated the exemption given to senior citizens over 60 years and another category of senior citizens over 80 years which was anticipating the future reality. Prof. Kaushik appreciated tax reforms underway including Goods and Services Tax (GST) and the Direct Tax Code (DTC) which were under discussion with several stakeholders including the State Governments and the intention of the Finance Minister to bring a Constitutional Amendment Bill to facilitate this was a very welcome step.

Mr. Sarav Periasami, President and CEO of PERI Software Solutions Inc. emphasized the importance of education and the necessity to bring about clarity for inviting foreign investment in education sector in India. He appreciated the increased allocation of funds by 24% over last year. He said that financial resources were not the only constraints but clarity in regulation would create a favorable climate for developing this very vital sector. He said that increase in Minimum Alternate Tax (MAT) by 0.5% will affect business sentiment. He also said that levying service tax on other services or bringing in more items under the excise would also be a dampener for business sentiments.

All panelists felt that though growth was an imperative for raising the level of living standards, control of inflation was also very important. Inflation was detrimental to fixed income and lower income groups and supply constraints should be progressively removed.

In the lively question-answer session, comments about current account deficit, declining FDI, comparison of growth in China and India, encouragement to innovation, contribution of non-resident or persons of Indian origin abroad, etc. were responded to by the panelists.

The lively interactive discussion was followed by dinner.

Event From Date : Feb-28,2011 Event To Date : Feb-28,2011

Labels:

Allocation,

Bond Markets,

Budget,

deficit,

Direct Tax,

Education,

FDI,

Fiscal,

Growth,

India,

Indirect Tax,

Tax

Tuesday, March 1, 2011

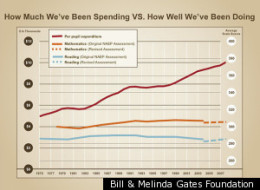

Flip the Curve: Student Achievement vs. School Budgets

Bill Gates is right about the importance of teachers in the future success of students. More resources on more, better, inspiring and dedicated teachers would produce better educated future workers in the labor market and students entering colleges. The same hold for aspiration

http://mhk

Read the Article at HuffingtonPost

India Budget 2011-2012

Remarks by Prof. S.K. Kaushik on Panel Discussion of Union Budget 2011-2012 at the Consulate General of India on 28.02.2011

Budget is by its very nature a very complex document representing government policy on the economy, its fiscal affairs, allocation of resources between today and tomorrow and specific relative importance of various sectors and activities.

All of it could be divided into three areas: revenue, expenditures and policies in the domestic and external sectors of the economy.

On the revenue side the Finance Minister has continued highest importance given to reduction in income tax and slight increase in indirect taxes. The direct tax policy, a continuation of reforms that began in 1991, continues to be used to encourage income generation.

The overall burden of income tax is almost nil on lower incomes and a maximum of 30 percent on the upper incomes.

India’s income tax rates are among the lowest in the world and they make India very competitive on that variable.

It is also redistribution in that the low income and the older persons do not pay much while overall India takes in less than 11 percent of GDP in taxes.

Income taxes contribute something like 4 percentage points of the 11 percent.

Indirect taxes are slightly increased to tax people at the consumption level slightly more. No one can escape the excise and sales taxes so while it is slightly regressive the low income have the income and government subsidies to be able to pay these taxes. This approach makes the overall tax system a generally fairer one.

The government is also trying to have a better mix of tax revenue from income, corporate, sales, excise and customs duties within its 11 percent or so of tax to GDP ratio.

On the expenditure side the budget underscores the importance given to infrastructure investment, employment guarantee scheme as an income support scheme, agriculture, education, financial institutions, etc. Mechanisms like banks and micro finance schemes are also strengthened.

The industrial policy remains in place without change so the excise duties remain as before. Corporate income tax, capital gains tax and dividend tax rates remain low and aggressively competitive in the world.

External financing, especially ownership of mutual funds is enhanced, with the expectation of increased portfolio investments by FIIs and others.

On FDI we are told that discussions are underway to further liberalize the FDI policy.

All together it is a balanced approach budget with a little bit for every sector and segment of the economy as continuation of current government policies.

Economists used to discuss balanced and imbalanced economic growth. This budget is an example of a balanced economic growth model.

Budget is by its very nature a very complex document representing government policy on the economy, its fiscal affairs, allocation of resources between today and tomorrow and specific relative importance of various sectors and activities.

All of it could be divided into three areas: revenue, expenditures and policies in the domestic and external sectors of the economy.

On the revenue side the Finance Minister has continued highest importance given to reduction in income tax and slight increase in indirect taxes. The direct tax policy, a continuation of reforms that began in 1991, continues to be used to encourage income generation.

The overall burden of income tax is almost nil on lower incomes and a maximum of 30 percent on the upper incomes.

India’s income tax rates are among the lowest in the world and they make India very competitive on that variable.

It is also redistribution in that the low income and the older persons do not pay much while overall India takes in less than 11 percent of GDP in taxes.

Income taxes contribute something like 4 percentage points of the 11 percent.

Indirect taxes are slightly increased to tax people at the consumption level slightly more. No one can escape the excise and sales taxes so while it is slightly regressive the low income have the income and government subsidies to be able to pay these taxes. This approach makes the overall tax system a generally fairer one.

The government is also trying to have a better mix of tax revenue from income, corporate, sales, excise and customs duties within its 11 percent or so of tax to GDP ratio.

On the expenditure side the budget underscores the importance given to infrastructure investment, employment guarantee scheme as an income support scheme, agriculture, education, financial institutions, etc. Mechanisms like banks and micro finance schemes are also strengthened.

The industrial policy remains in place without change so the excise duties remain as before. Corporate income tax, capital gains tax and dividend tax rates remain low and aggressively competitive in the world.

External financing, especially ownership of mutual funds is enhanced, with the expectation of increased portfolio investments by FIIs and others.

On FDI we are told that discussions are underway to further liberalize the FDI policy.

All together it is a balanced approach budget with a little bit for every sector and segment of the economy as continuation of current government policies.

Economists used to discuss balanced and imbalanced economic growth. This budget is an example of a balanced economic growth model.

Subscribe to:

Posts (Atom)